Why the Future of Performance is Brand-First

As CPAs rise and tracking fades, awareness and trust are the new drivers of efficiency.

The End of the Old Divide

For most of the last decade, performance and brand marketing have been treated as separate disciplines. One was expected to deliver immediate sales results, while the other built future demand. In a world constrained by privacy laws and weakened tracking, that separation no longer works.

Digital advertising once thrived on perfect visibility. Marketers could follow a click from ad to sale, optimise bids in real time, and credit every conversion precisely. Those days are gone. Cookies are disappearing, consent rates are falling, and signal quality is deteriorating across every major platform.

As tracking precision fades, what remains visible is brand strength. Awareness, memory and trust now determine whether users click, convert and stay loyal. In short, brand investment has become the main driver of performance efficiency.

The Cost of Signal Loss

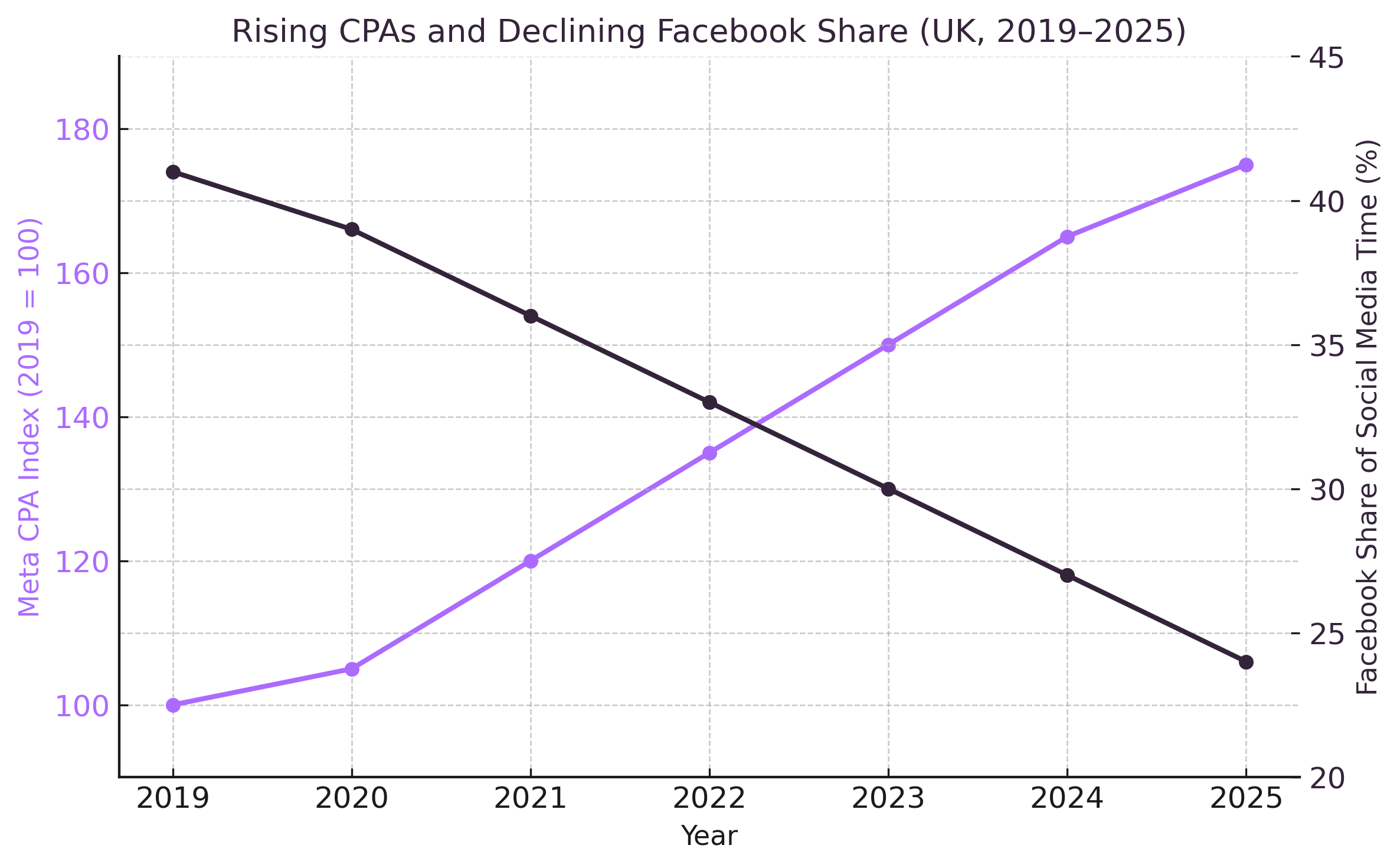

Across Meta and Google, cost per acquisition has risen sharply since 2021. Meta’s own data shows CPAs up more than 30 per cent on average across ecommerce and lead generation advertisers since the introduction of App Tracking Transparency on iOS. Google advertisers have seen similar trends, with many reporting 20 to 40 per cent higher CPAs year-on-year, even when conversion volumes stay flat.

The cause is straightforward. Platforms are losing visibility of user behaviour beyond their own ecosystems. With less conversion feedback, machine learning models cannot optimise as precisely, and budgets are wasted on lower-intent impressions. As signal strength falls, algorithms revert to broader targeting, driving up competition for known audiences.

At the same time, platform usage itself is shifting. Facebook’s share of total social media time in the UK has fallen from 41 per cent in 2019 to under 25 per cent in 2025. Time spent on TikTok and YouTube Shorts has grown, but these platforms have weaker conversion paths and more privacy restrictions. The result is a perfect storm: fewer measurable signals, more fragmented media consumption, and higher acquisition costs everywhere.

Our cross-channel efficiency models show that consistent above-the-line investment mitigates this effect. When advertisers maintain steady brand spend, especially on television and online video, digital CPAs rise more slowly. In several retail and subscription categories, each 1 per cent increase in aided brand awareness correlates with a 2 to 3 per cent improvement in paid social CPA within three to six months.

Brand as an Efficiency Engine

The IPA’s long-term studies support this pattern. Campaigns that combine brand and activation outperform those focused on activation alone by an average of 60 per cent in long-term ROMI. However, the benefit is not purely long-term. A stronger brand lifts the immediate performance of all lower-funnel activity.

For example, when advertisers increase television or online video spend by 10 per cent, branded search queries tend to rise within weeks, even without changing keyword strategy or bid levels. That rise in search intent directly improves click-through rates and lowers average CPC. The performance channel appears more efficient, but the underlying driver is memory, not media optimisation.

Brand investment therefore acts as an efficiency engine. It keeps acquisition costs lower for longer, even as tracking degrades and algorithms lose context.

A New Model for Growth

The next phase of growth in digital marketing will not come from more precise targeting or attribution. It will come from resilience built through brand equity. The marketers who thrive will treat brand spend not as a cost centre, but as a stabiliser for their performance media.

To operate in this new environment, three priorities stand out:

Balance long and short horizons

Maintain a stable base of brand spend to preserve efficiency in your lower-funnel campaigns. For established brands, this usually means 60 per cent brand and 40 per cent activation. For newer brands, a 40:60 split is more realistic until awareness builds.

Measure beyond the click

Use marketing mix modelling to capture how brand spend influences downstream performance metrics such as CPA and conversion rate. This provides a more complete picture than click-based attribution, which misses the offline and cross-device effects that now dominate.

Track indicators of trust and attention

Monitor direct traffic, brand search, and view-through engagement as leading indicators of performance efficiency. These are early signs that your brand is maintaining mental availability in a cluttered, privacy-conscious landscape.

Reframing Performance

The idea that performance and brand are opposites is a relic of a more measurable era. In today’s privacy-first, signal-poor market, brand strength is what allows performance to happen at all.

Brands that invest consistently in awareness and trust find their CPAs more stable, their conversion rates higher, and their dependence on platform algorithms lower. Those that continue to chase attribution precision will face diminishing returns and rising costs.

The future of performance is not post-brand. It is brand-first.